The year end is always a time for reflection.

During the past year I read my usual mix of popular books, serious books, research articles, review pieces, digital articles that captured my imagination, some poetry, novels, practical guides,magazine articles professional and otherwise. So a pretty full digest of reading activity. I do not read narrowly as you can see. Reading is perhaps the most rewarding activity in many respects. Epicurus might have said reading is essential to a better life.

So what made my life better for reading it? Here I pick out just a few that have. I do so in no particular order other than that they occur to me.

Healthcare Expenditure – some facts

Reading Society Now an annual magazine published by the ESRC I learned some important healthcare statistics that affect all our lives. Between 1997 and 2009 spending on healthcare per person more than doubled rising at a rate of 7.5 per cent a year on average according to the Office for National Statistics (ONS). Since then it has flattened out rising less than 1.3 per cent. In 1997 spending was under £1,000 per person by 2007 it reached £2,000 per person. It has stuck near to this level since as a consequence of the financial crisis. If you need a cataract operation now the average waiting time is above 93 days in 2013 it was just 69 days. Waiting times for operations are generally rising. Visits to Accident and Emergency are also more likely to be in excess of the four hour limit. One paradox is that the UK spent 8.1 per cent of GDP on healthcare in 2013 more than all other G7 countries. Might it be more than simply spending? Have the recent healthcare reorganizations made things better or worse? Is healthcare well managed?

In addition to reading about the many complex challenges facing healthcare it is reported in the press and backed up by personal experience that it is difficult to get GP appointments. Treatments have become somewhat of a post code lottery for some illnesses. There are significant differences across a disunited kingdom. So what can be done? Endless re-organization and increasing bureaucracy is probably not the answer. There are well qualified caring people working in healthcare. Privatizing services is probably a retrograde step and would lead to a more divisive society based on wealth. A progressive tax system can certainly fund the service but are we prepared to pay? A civilized society should take pride in the health service offered. Should someone’s misfortune be a shareholder benefit in a market system for health care? Adam Smith is often held up to justify free market choice. However, here I refer to his earlier work of moral philosophy where he states in the opening chapter “How selfish soever man may be supposed, there are evidently some principles in his nature, which interest him in the fortunes of others, and render their happiness necessary to him, though he derives nothing from it except the pleasure of seeing it.” I certainly do not have all the answers but reading this material made me think about the many issues needing attention beyond the inadequate rhetoric of many politicians. There is a time to do the right thing no matter how difficult.

Lost in France

During the year I was reminded of a relatively local story about a Welsh International Goalkeeper who like many sportsmen at the time in 1914 went off to do their duty in the First World War. Leigh Roose is described as: playboy, scholar, soldier, maverick and a star footballer. This book written by Spencer Vignes is a must read not just for every person interested in football but for anyone interested in human experience. Leigh lived in Holt near Wrexham in North Wales and he was by all accounts quite an extraordinary character. It is not simply the compelling story of someone who changed the lives of most of the people who he came into contact with but it is a story of interest for the way the writer set about the task of researching his life. Dick Jenkins was the 96 year old nephew of Leigh who the author tracked down living in Shrewsbury at the time in 2000 and spent a number of years teasing the story out piecing the evidence together from multiple sources for our enjoyment and what a treat it is. Leigh also changed the part the goalkeeper played in Association Football. Every episode in Leigh’s journey from Wrexham to the Western Front is carefully presented to tell an extraordinary story of one special person renowned for his special skills as a goalkeeper and human being. I don’t want to spoil your enjoyment. I commend you to read it you will not be disappointed.

Ever wondered what Moll Flanders and the Bank of England have in common?

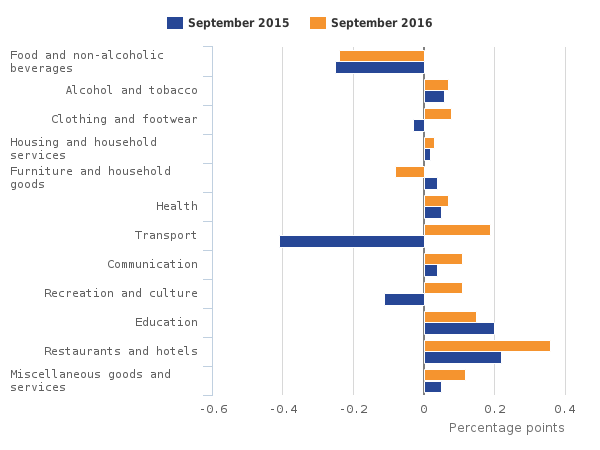

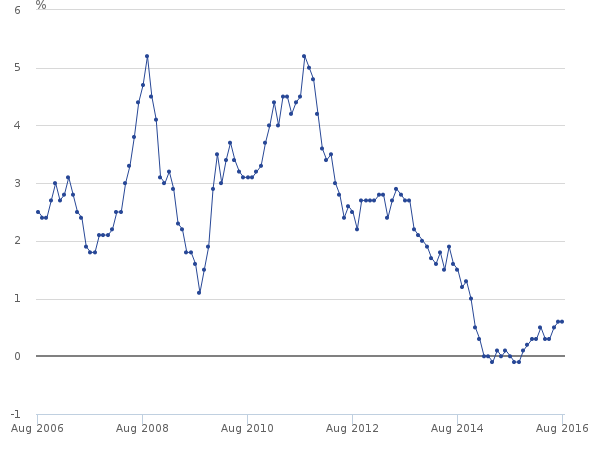

The idea of ‘projectors’ those who engage in projects was something that stimulated my curiosity. I heard Valerie Hamilton speaking on BBC Radio 4 about the topic and followed up by tracking down her book with Martin Parker “Daniel Defoe and the Bank of England: The Dark Arts of Projectors”. This is an interesting book for many reasons.The book is written by two academics in different disciplines. One coming from an English Literature background (Valerie) and the other from Organization Studies (Martin). The book tells the story of how these two worlds overlap. Intertwined with the development of the Novel as a piece of fictional writing and the world of projectors, one of whom established the Bank of England as a project. Defoe wrote an essay on risky projects in 1697 just three years after the Bank of England was formed in 1694. Projectors were essentially entrepreneurs engaged in risky adventures and one such project was the formation of the Bank of England. It was established with the purpose of promoting the ‘public good and benefit of our people’. it did so by managing interest rates to control inflation along with managing the supply of money. These two policy instruments remain in place today. In his time Defoe was an erstwhile agent, writer and projector himself. His most famous novels are Robinson Crusoe and Moll Flanders perhaps the first best selling novel and rollicking good read. Defoe also wrote many non fiction works including an essay on how to plan the English economy beating Adam Smith by some fifty years. The book provides and interesting detailed account of the thin line between fiction and what we regard as fact. The Bank of England was as much a work of fiction for a political end as indeed was Moll Flanders or Robinson Crusoe based on the real life of Alexander Selkirk in the latter case. I particularly liked the quote from William Wordsworth that reinforces such false distinction of categories. It is perhaps something that people would do well to heed in the modern age where alternative views of the world are shouted down by the vested interests of those in power.

“In weakness we create distinctions, then

Believe that all our puny boundaries are things

Which we percieve and not which we have made”

William Wordsworth, c.1799, cited by Hamilton and Parker 2016

Ever wondered if most of what you learned about economics is wrong?

Bad Samaritans by Ha Joon Chang was a present which I took a quick look at and began reading. I was unable to stop until I finished the whole book. I had read Chang’s later book “23 Things they Don’t Tell You about Capitalism” which is an excellent book debunking the myths of capitalism and free market economics last year. Bad Samaratins was an earlier work and probably gave Chang the confidence and intellectual frameworks from which to write the latter. Most interesting about this earlier book is the how the author’s biography and experience is woven into the episodes reported in the text. Chang was born and brought up in the Republic of Korea. He grew up near Seoul a few years after a bloody civil war had divided the nation. Two of today’s super powers and their allies were also involved in the Korean War (1950-53). Soviet troops held the peninsula north of the 38th parallel and the US held the south. In 1948 the South declared a Republic and in 1950 the North invaded. Approaching three million people died in the war. What happens after this is largely the subject matter of this book. However, it is not simply about Korea, it is a story of Globalization and failed economic policies that won’t go away. It is revealing in relation to how and why we have a world order as it is today. It explains why poor nations remain poor and why rich nations get richer. Within the narrative we witness how the lives of ordinary people are touched by economic fallacies and the mantras of the political elites. Another thing interesting about this book is in relation to what I know from studying economics and globalization over many years that many a received wisdom have a dubious basis in fact. A point that resonates strongly with the earlier read about the establishment of the Bank of England and Projectors. Defoe figures in this latter book too. This time in the guise of Robinson Crusoe oft used as the basis for many an economic lecture on trade and comparative advantage.

Chang relates his own schooldays to the economic well-being of South Korea. Starting school in 1970 he notes that there were 65 pupils in his class. They had few school books and those they were able to access were often imported, illegal copies. As he progressed through school class sizes went down and literacy rates increased. He remarks that standing in a museum with his friend and mentor George Stiglitz they were looking at pictures of a very poor South Korea after the second world-war, one that he had experienced growing up. A group of young school girls standing behind him could not believe it was Korea and remarked it looked more like Vietnam. In the hi-tech world of modern Seoul with Samsung and other leading corporations in swanky headquarters it is easy to see why.

The duplicitous world of economic policy often purports to be doing good when in fact it is doing the complete opposite is the substance of Chang’s thesis. A thesis that is well-argued with strong evidence to support the claims. Chang, recognizes that policy makers themselves are often misled by the orthodoxy of the dismal discipline as Carlyle called it. Dismal not because there is no substance as some believe but rather dismal because the consequences of economic policy often have bad outcomes.

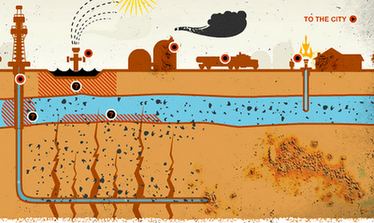

Britain’s wish to re-balance the tea trade deficit with China ended badly in the Opium Wars. Similarly, the actions of Britain to ensure that trade policies in the colonies did not interfere with the home country’s income stream from foreign trade by denying access to higher value earnings from production beyond raw materials was yet a further example of being the bad Samaritan. The neoliberal goals of growth and increasing globalization driven by institutions such as the IMF and the World Bank established by the wealthier nations to modernise the developing economies have according to Chang simply kicked the ladder to prosperity away from them. Keynesian policies applied to stimulate developed economies in a downturn have been applied only to the wealthy countries elsewhere strict monetary controls imposed made them worse off since the 1950s. Austerity has of course seen the spread of monetary policies to the wealthy too in recent times.

One may conclude that economic policy and indeed economics itself is but one construction of the social world we inhabit. As Keynes suggested “Practical men, who believe they are quite exempt from any intellectual influence, are usually the slaves of some defunct economist” (Keynes,1936:383).

Empire of Cotton – A New History of Global Capitalism

This book by Sven Beckert is yet another stimulating read I discovered which tells the ways in which Cotton has contributed to economic wealth and power. Often at the expense of poverty for many working in the lower value added range producing cotton. Again there is a connection to Chang’s claim that the British Empire was keen to ensure that cotton was simply grown as a commodity in the Empire (India and the American Colony) they certainly did not want these nations to enter the conversion process of turning cotton from raw material into finished goods. These higher value added activities required technical skills and machinery innovation that they wanted to keep tight hold on. The production, distribution and consumption of cotton is a story of so called industrialization but it is also much more. It is a story of political intrigue and double dealing, of enterprise, of skill, and of innovation. Wars have been fought over cotton. It has also delivered great wealth to those who were able to harness and shape the political forces of the industry to their personal advantage and it has caused poverty and misery for others.”Domination and exploitation” alongside “liberation and creativity” is the way the author put it.

Cotton is still an important industry. It consumes vast amount of water in production. As a natural fibre it has often been preferred to ‘man-made fibres’ arguing that it is sustainable as a renewable natural resource. This is overlooking the damaging aspects within the growth and production of cotton textiles including water usage for growth and colouring processes later in the supply chain.

John Wilkinson – King of the Ironmasters

Frank Dawson’s book gives a wonderful account of the contribution Wilkinson and Iron made to the first industrial revolution. I have read a number of books on the subject over the years and have always been intrigued at the motivation, determination, creativity, innovation and marketing skills of this greatest of all iron masters. From his roots in Cumbria to his trade apprenticeship in Liverpool to the setting up of his iron Works at Bersham, Brymbo, Willey nr Brosely, Bradley and Coalbrookdale. The book is a fascinating history of the man, his family, a nascent iron industry and the places touched by his endeavours.

It tells the story of remarkable achievement and of the relationship between John Wilkinson, Mathew Boulton and James Watt who drove much of the innovation. Bersham was purchased by James Watt to establish his new iron works. It was at Bersham that he developed the cannon that helped Nelson win the Napoleanic Sea battles. The secret being to bore the cannon rather than rivet two parts which is what the French did. Often these cannons blew apart when the rivets did not withstand the blast. This alone could sink a ship. Wilkinson later purchased Brymbo Hall a much larger site. There was a steel works on this site until 1991 when it was demolished and much of the equipment and useful bits were taken by a Chinese Steel Company numbering the pieces and rebuilding the site in China.

In his heyday Wilkinson even minted his own coins as shown in the photograph. These became know as ‘Druids’ and ‘Willy’s’. They were produced for about ten years (1787-1797) to satisfy the demand for small coins not satisfied by the state. They were used to pay workers and could be exchanged in the locations where the works were.

John Wilkinson had a family feud with his younger brother William that would eventually destroy the successful business he had built. These arguments incurred heavy legal bills. So acrimonious was the fall out that William tried to destroy John’s relationship with Boulton and Watt by suggesting that the steam engines they had built were being pirated by his brother. However, this claim hurt William and his wife who was the daughter of Boulton and Watt’s agent as it transpired that it was he that had entered into arrangements to copy the engines.

When John Wilkinson died he was transported from near Bristol where he died to Castle Head in Cumbria by Horse and Cart with the iron coffin he had prepared for burial in advance of death. His carriers nearly lost the coffin to the sea near Castle Head when the tide came in rapidly and dislodged the coffin into the water. Luckily the men returned the next day to find the coffin revealed after the outgoing tide and were able to recover it for burial. On the sale of Castle Head after his death the body was reburied at Lindale Church near Cartmel.

Brymbo Hall was eventually sold to pay debts. The steel works at the site continued and the Hall itself survived until the 1980s when it too was demolished after falling into considerable disrepair. There is much more in the book. For anyone wishing to find out more about the work of Wilkinson and the foundations and development of the iron and steel industry this book is a gem.