Friction in Supply Chains

I have been researching and writing about supply chain strategy for many years (see Supply Chain Strategies: Demand driven and Customer focused). Strategies to reduce cost, improve efficiency and increase effectiveness usually involve taking unnecessary cost out of the chain, reducing what supply chain professionals refer to as friction which is an obstacle that slows throughput and increases cost. In removing friction essentially we unblock the chain and smooth the flow so that goods move seamlessly from producers to customers. If large volumes of transactions in supply chains are moving through from tried and tested suppliers who are used to dealing with others in the chain it becomes easier to achieve a frictionless supply chain and one which is transparent meaning that we can locate goods quickly within any point in the chain. Firms have invested heavily in systems to achieve transparent (track and trace technologies) and frictionless movement through their supply chains. This is better for lowering their operational costs and it improves performance in terms of on time and complete deliveries for customers.

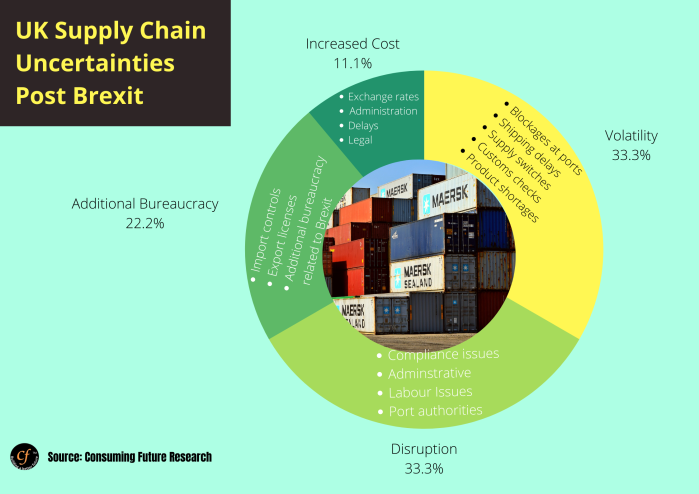

EU trade with the UK is about 54 per cent in terms of imports and we export 47 per cent of UK goods and services to the EU. So about half of our trade is inter EU. If you have few tariff or trade barriers goods move between member states without friction. Hence little cost is attributed to friction in supply chains. There is less volatility. Volumes are transferred fast by road, rail, ship and air. Value is retained because there is less waste due to holdups at customs, ports or transfer hubs. This is particularly important for perishable goods such as food. There is no need to hold additional Just-in-Case (JiC) inventories. Just-in-Time (JiT) supply chains can be managed smoothly with Radio Frequency Identity Data (RFID), mobile devices and sensors with the ability to make transparent the supply chain. As a consequence firms can operate with lower levels of working capital employed. This benefits everyone not least of all customers who get what they want when they need it. Frictionless trade allows for fairer competition in the market because there are no artificial barriers to trade. Put simply, government interference in the market mechanism is lowered. Frictionless supply chains are better placed to lower barriers not build them unlike a frictionfull supply chain. Research by Consuming Future Research (CFR) shows that volatility and disruption are likely to increase by 67 per cent in trade with the EU after Brexit if no deal happens. It will still increase if a deal is struck but we do not know by how much that would depend on the terms of the deal. Bureaucracy will increase by 22.2 per cent adding to increased costs of around 11 per cent. Brexit increases supply chain risk in what has been fairly low risk trade with the EU. It will likely push up prices and ultimately it will be consumers who will pay more for goods and services unless these costs are mitigated in some way. Covid 19 amplifies these difficulties as well as introducing disruptions of its own.

Early in 2020 around 90% of lettuces, 80% of tomatoes and 70 % of bananas were imported via the EU. The UK imports 50% of its food with 30% coming from the EU.

The British Retail Consortium, a trade body, calculates that the average tariff on food imported from the EU will be more than 20 per cent, with some staple foods attracting particularly high levies. The tariff on beef mince is 48 per cent, cucumbers 16 and oranges 12.

Brexit: How much will food prices rise if UK does not agree a trade deal with the EU? Ben Chapman, 20th September 2020, The Independent Newspaper.

Market distortion can have unintended consequences. For example, some hard Brexiters have suggested lowering food tariffs to zero per cent but this will have detrimental consequences for domestic farm production.

The gains made by Supply Chain Professionals in the last two decades are about to be reversed by political decisions erecting artificial barriers to trade in the transactions between the UK and EU. One likely consequence is that this reintroduction of friction into many supply chains will increase transaction costs for most, if not all firms. There will of course be winners and losers. It will make it more costly to cross the borders and if you need to do so more than once as is the case with many intermediary goods then it might pay to relocate to avoid these transaction costs depending on size and volumes.

The Island of Ireland

This perhaps is somewhat reminiscent of Hilary Putnam’s Twin Earth Thought Experiment with semantics at the heart of the problem. It is the nettle that the UK government have been reluctant to grasp. While the Republic of Ireland remains in the EU the six counties in the North being part of the UK will be leaving. Special arrangements are supposed to accommodate the transition. Many, however, are unclear about exactly what these arrangements are including government when questioned. A lot of red tape, bureaucracy and obfuscation is what insiders are telling me. International product certifications and standards will play their part in this brave new world of in or out. More than 90,000 SME’s will need to become versed in import and export regulations from 1st January 2020.

Recent Evidence

The overall cost of the UK leaving the EU has been estimated equivalent to the total paid into the EU during its forty-seven year membership. Estimates put the figure at over £200 billion (Sources: Bloomberg Economics; LSE; Business Insider). These costs are likely to increase if there is no deal. The Institute of Fiscal Studies (IFS) noted that trade deals are supposed to lower prices for consumers but this appears unlikely even under the best scenario prices are likely to increase by about 6 per cent according to studies by Warwick and Bristol Universities. A recent study reported Covid 19 is likely to cost around £40 billion which places the impact from Brexit in context (LSE Study, The Guardian). A number of industries including automobile and aircraft manufacturers are already under pressure from lower demand due to Covid 19 and because of looming environmental regulations and proposed government policies to lower CO2 emissions and improve air quality.

According to the Society of Motor Manufacturers and Traders (SMMT), £735 million has been spent by manufacturers on Brexit measures already, with £235 million spent in 2020 alone.

uk.motor1.com/news/453626/carmakers-spending-billion-on-brexit-preparation/

The Chartered Institute of Procurement and Supply (CIPS) survey of supply chain professionals (21st October, 2020) shows that most expect to pay 22 per cent more for goods this Christmas due to a combination of Covid 19 and Brexit disruptions. Most of the cost will be passed on to consumers. Nearly half of those surveyed expect delays in deliveries at borders of a week or more. A Brexit no deal would worsen the situation. One in three supply chain managers have said that they have selected a new UK supplier to replace an overseas supplier in an attempt to reduce risks and approaching 40 per cent have indicated that they have lost a supplier due to bankruptcy as a result of Covid 19.

Bloomberg have reported that there are critical gaps in planning for border systems to cope at the end of the transition period (31st December 2020). This lack of preparation is likely to significantly disrupt supplies and increase prices. The new freight smart system is designed to allow only trucks with appropriate documentation into Dover and to reduce hold-ups on the M2 and M20 approach roads. The UK Government has promised to be ready by 1st January 2021 (in beta test mode). Logistics UK the industry body has said they do not expect a fully functioning system until April 2021. It is problematic because even if it is introduced in January no one is trained as yet to use it. Many logistic companies and others in the supply chain are ill prepared for what disruption lies ahead according to Logistics UK. According to Supply Chain Digital the government stated worse case scenario is 7,000 trucks maximum queuing at ports with associated delays of two days. This would appear optimistic given other evidence here. The expectation is that the first three months of 2021 will be problematic and there will likely be large disruptions to all supplies including food and medical supplies; the latter one reason why the government is currently stockpiling supplies. For commercial businesses facing other medium to long-term disruptions due to Covid 19 with falling revenues and non-existent cash flows it is not an option to invest heavily in inventories.

A return to WTO terms would put the UK at a competitive disadvantage with its current leading supply chain partner the EU. No longer a partner but a competitor unless a mutually beneficial deal is struck. The EU plan to introduce full border checks for goods entering the EU from 1st January 2021. Goods entering the UK from the EU will have another six months before full checks are in place. Often when one part of a system is disrupted repercussions roll out in waves to other parts. It could of course cost lives if medical supplies are held up in the chaos. It is more than likely that some, if not all of the following issues may be realized. Deal or no deal there will be increased friction in supply chains and increased transaction costs as a consequence with possible increases in delivery delays and higher inventory levels by holding safety stocks just in case. Higher risk of deterioration, redundant, scrap or waste for those inventories held in case there is supply disruption. Customer service levels are likely to deteriorate as delivery times become extended and consumers will most likely pay the price for the lack of planning by government to ensure a smooth transition.

Free Ports Plus ça Change

The UK Government this week confirmed that they will be re-introducing Free Ports. Free ports are not a new concept they have been around since the Cinque Ports were established in the 12th Century and Dover was one of them. The attraction is that they are tax free zones aimed at stimulating the regional economy in which they are situated. The government has committed to having one in each of the devolved administrations, Northern Ireland, Scotland and Wales. Aberdeen, Blythe, Belfast, Sunderland and Teesside have all been identified as some of the areas that could benefit. They may be considered as part of the levelling up agenda by government. Interestingly Free Ports were last introduced in the UK in 1984 by Prime Minister Thatcher’s Government and lapsed under Prime Minister Cameron in 2012 when the government chose not to renew legislation. Belfast, Cardiff, Liverpool, Prestwich and Southampton were all free ports during this period. The Isle of Man a crown dependency neither part of the UK or the EU still has a free port. Government claims free ports could add £9 billion to the UK economy. Rather than stimulate new business it may simply accommodate existing businesses who move in to Free Ports to avoid taxes. Thus, moving the existing revenues into a tax shelter and lowering the tax take.

It should be noted that the UK had free ports whilst part of the EU and the EU currently has 82 free ports. So it should not be assumed that this is enabled by Brexit. Free ports may help establish tariff free zones if there is no deal. It is likely this is the reason they have been re-established now. The government could offer aggressive tax incentives that make it attractive to invest in free ports to avoid taxes for overseas companies. Put differently, create tax havens. As the UK seeks to establish ten free ports the EU is clamping down on the 82 they have over concerns about organized crime, money laundering and the financing of terrorism. The establishment of Free Ports right now is likely to irritate the EU which is something the timing of this announcement may have been designed to do as part of UK tactics to negotiate a deal. The WTO or member states may also object.

Supply Chain Strategies to Mitigate Risks

Most mitigation strategies to fix the problem are not a quick fix. It takes time to find new markets or to source new suppliers if transaction costs and frictions disrupt existing fast flow systems. As a strategist the best option is to avoid this option but it appears too late for that now. So mitigation is the best but not necessarily the optimum solution.